VAT rate configuration

In the event that the school is VAT exempt or has a different VAT rate than the regular 22% rate, it will be necessary to configure it in the system and choose one as the default.

To enter new VAT rates, navigate to Administration → Economic Settings and go down to the section VAT rates.

By default, the ordinary VAT rate of 22% will be present.

IMPORTANT: in case the school is VAT exempt, you should NOT delete the 22% VAT present by default in the system, but just enter another one at 0% and set it as default.

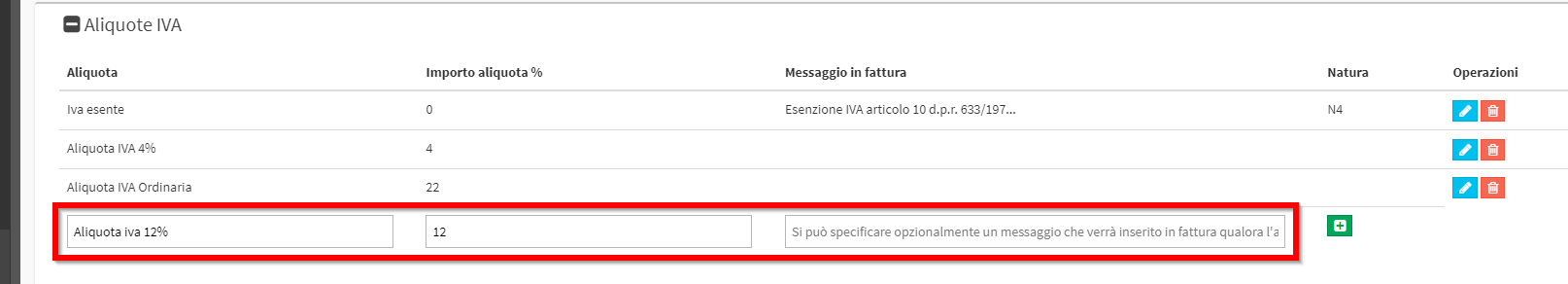

To add one or more VAT rates you will simply need to enter the name, the percentage amount and an optional message to appear on the invoice:

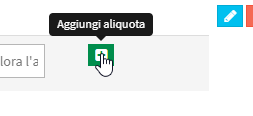

Click the "+" to add the new VAT rate:

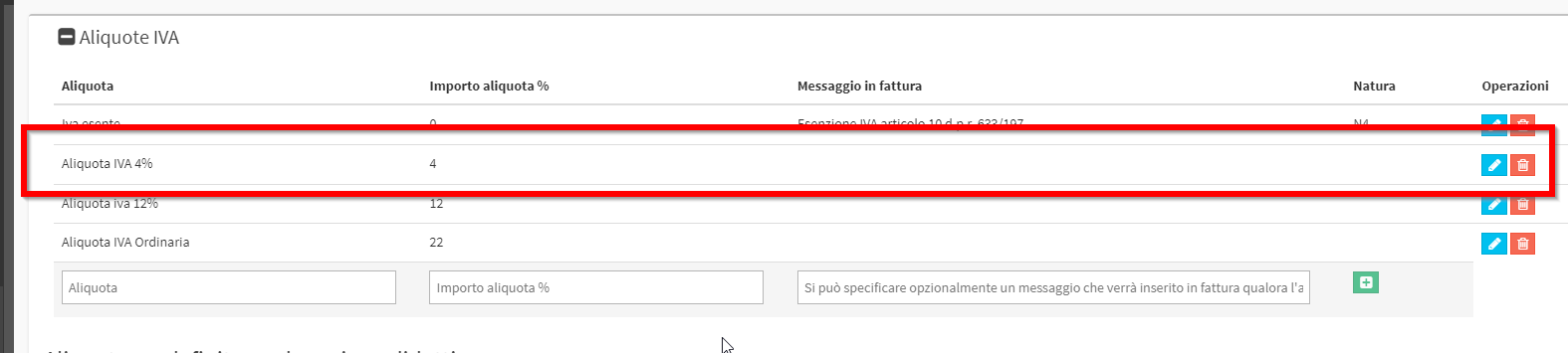

Now the newly created VAT rate will appear with the others:

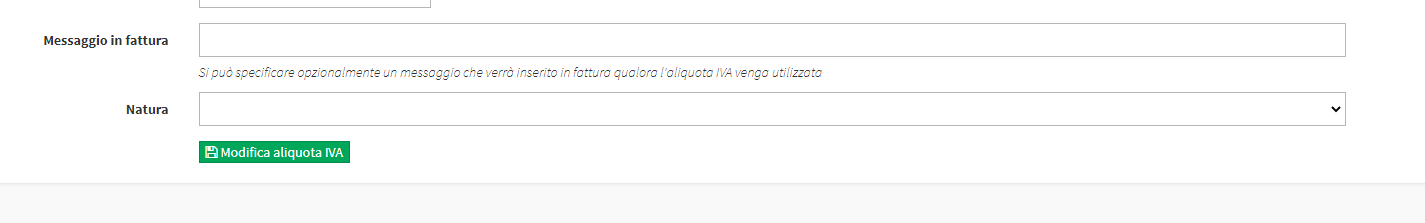

In caso di Fatturazione Elettronica attiva nel sistema, è possibile impostare la Natura dell’Iva per le aliquote Esenti.

Click the pencil icon to enter Edit and select Nature:

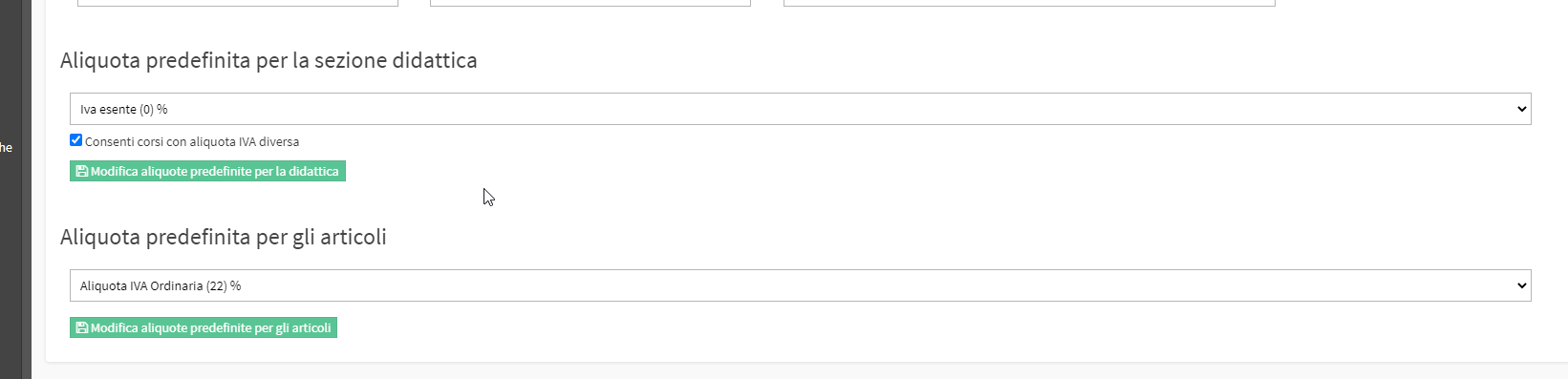

In case there are multiple VAT rates in the system, one can be set as the default for both the Didact and for the sale of items (Goods and Services):

Flag the checkbox "Allow courses with different rate" to leave the choice of which VAT rate to use per individual course (in case there are exceptions to the VAT set as default)