Configuring and Using Electronic Billing

Activation of Electronic Invoicing

In order to generate XML files of issued invoices, you will first need to configure some system settings.

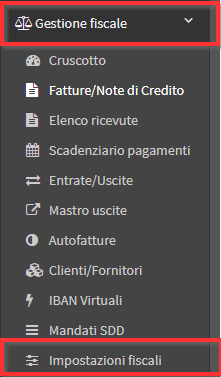

As a first step, navigate to Tax Management → Tax Settings:

Then click the edit on the Company line:

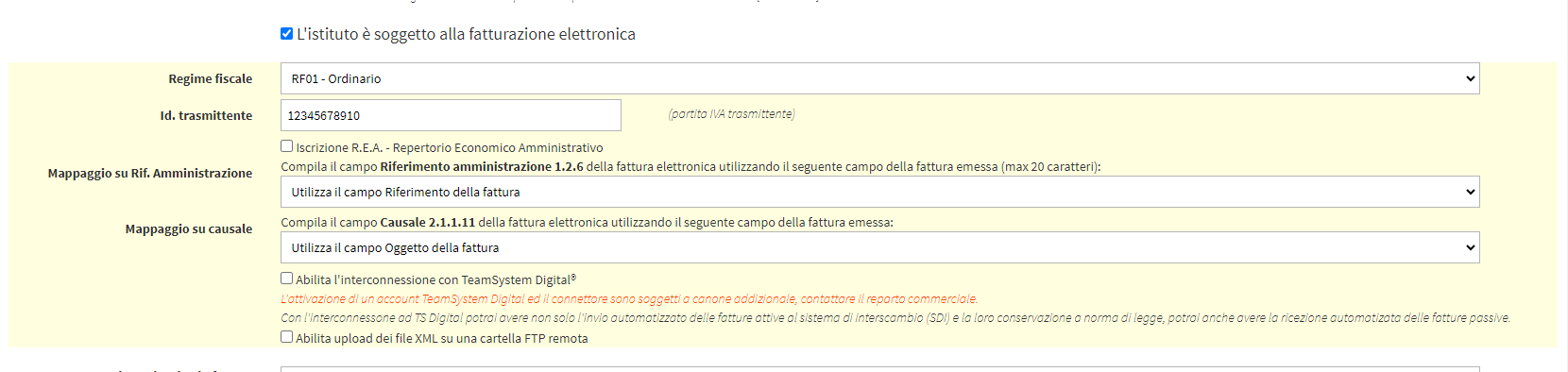

From the next page, scroll to about the middle, value the checkBox "The institution is subject to electronic billing" and enter the requested data:

- Tax Regime: Indicate the company's tax status.

- Transmitter id: The vat number of the provider for sending electronic invoices.

- R.E.A. registration:

- Office

- REA Number

- Share capital

- Sole shareholder

- Settlement status

- Mapping on Ref. Administration

- Mapping to causal

- Enables interconnection with TeamSystem Digital®: Enables direct interconnection with TSDigital for sending electronic invoices from ScuolaSemplice to sdi (Premium option can be activated on request).

- Enable XML file uploads to a remote FTP folder:

Save the operation by clicking the "Apply Changes":

![]()

Inclusion of the Nature of VAT Exemption

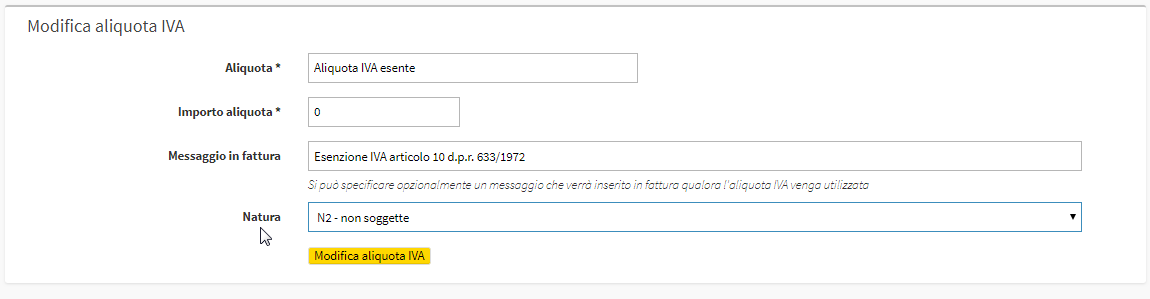

For the next step, in the case of system-configured exempt VAT, navigate to Administration → Economic Settings, scroll down to the section "VAT Rate" and click the edit icon on the VAT line used. Then enter the Nature of the VAT, i.e., the code prepared by the IRS, from the relevant drop-down menu and click the "Edit VAT Rate" to save.

Also from the economic settings, you will be able to see that all the payment methods present by default in the system, with which you can pay your invoices, are already set up with the relevant codes assigned by the revenue agency. If, on the other hand, additional payment methods have been added, ask support to associate the respective codes.

Generation of XML file of invoices

Following the quick setup explained in the previous section, you will be able to start generate XML files of the issued invoices. The invoice issuing process will always be the same as the one used (here the guide on issuing invoices).

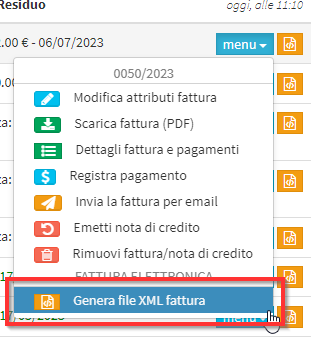

Once the invoice has been issued in the traditional way, navigate to Fiscal Management → Invoices / Credit Notes and click on the Menu → "Generate XML invoice file":

As soon as the XML file is generated, you will be able to: download it by clicking the icon ![]() ; view it by clicking the iconic

; view it by clicking the iconic![]() ; delete it by clicking the icon

; delete it by clicking the icon ![]() .

.

After both viewing and downloading the file (you will need to both view it to check for any errors) you will be able to send it independently to SDI.

PEC and recipient code

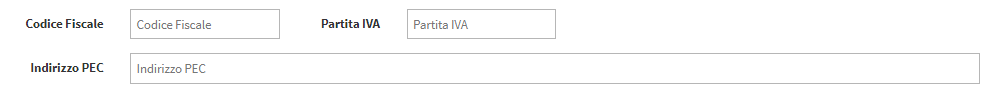

From the master records of students (Master records → Students ), tutors/supervisors (Registries → Tutors/Responsibles), customers and suppliers (Fiscal Management → Customers/Suppliers), you can enter PEC (certified electronic mail).

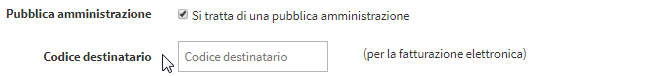

As for the recipient code, the box will appear only on registries with residence in Italy:

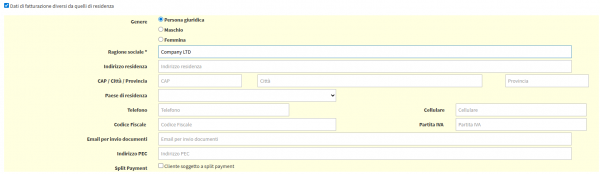

In the master records of students and tutors/supervisors, it is possible to enter the Recipient Code use the Billing data different from residence data (only if the different billing data belongs to legal person):

IMPORTANT: In the case of students and tutors/supervisors who are not legal entities, there will be no need to enter the seven-zero recipient code (there is no field), as the system will automatically enter it on the invoice.

In the master records, it will also be possible to check that these are Public Administrations or activate the Split Payment.