Configuration of the vignette and possible modification/deletion

To configure the vignette to be included on the invoice and/or tax receipt, navigate to Tax Management → Tax Settings and click the edit icon on the company line.

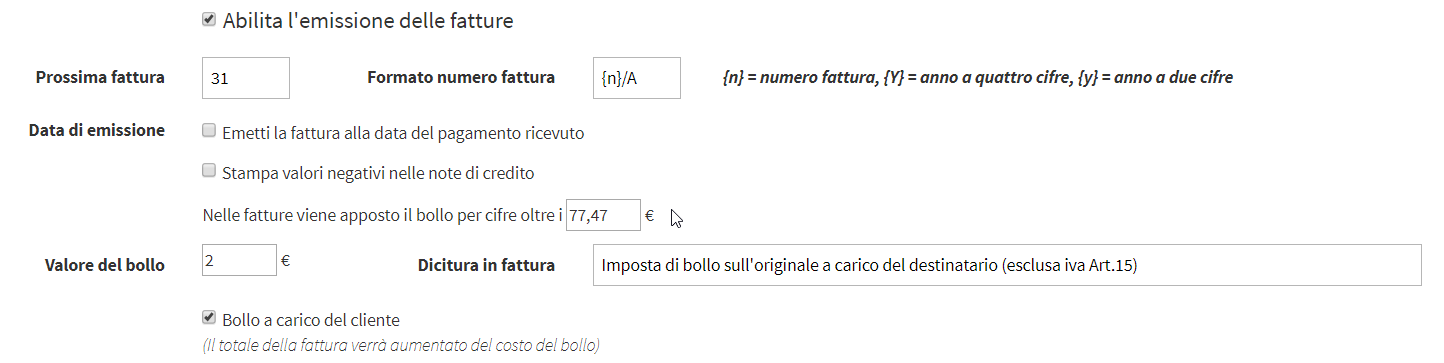

Invoice stamp configuration

Regarding the configuration of the stamp in invoices, scroll to the second section of the page and enter the amount above which the system should automatically put the stamp on the invoice, in case of VAT exempt.

Next, enter the value of the stamp and the wording that should come out on the invoice in the fees fields. Then specify, via the appropriate checkbox "Stamp charged to the customer", whether you intend to charge the customer for the stamp duty or not; if flashed, the total cost of the invoice will be increased by the value of the stamp duty; otherwise, it will be included in the cost and will be offset on a separate line.

Click the button at the bottom of the page "Apply Changes" to save the operation.

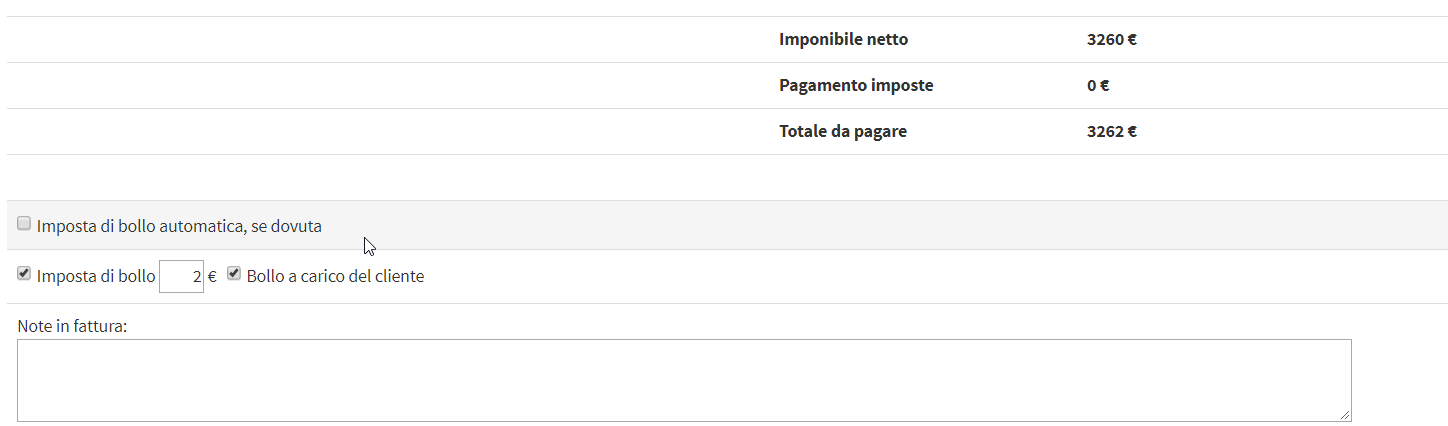

These tax settings, which will be used by the system by default, can always be changed punctually by entering individual invoice editing after issuing the invoice (or when issuing an invoice manually).

To change the stamping from an invoice, navigate to Tax Management → Invoices / Credit Notes and click on the "Show invoice details" on the line of the specific invoice. From the next screen, just above the space for any notes on the invoice, remove the flag from "Automatic stamp duty, if due". You will now be able to enter/edit the amount of the stamp duty and decide whether to charge it or include it in the cost.

For invoices to the Public Administration, the possibility of charging the stamp duty is automatically excluded, since it is provided by law that in this case it is the responsibility of the supplier (in the customer/supplier master data in the tax management, there is a flag to be entered in case of Public Administration)

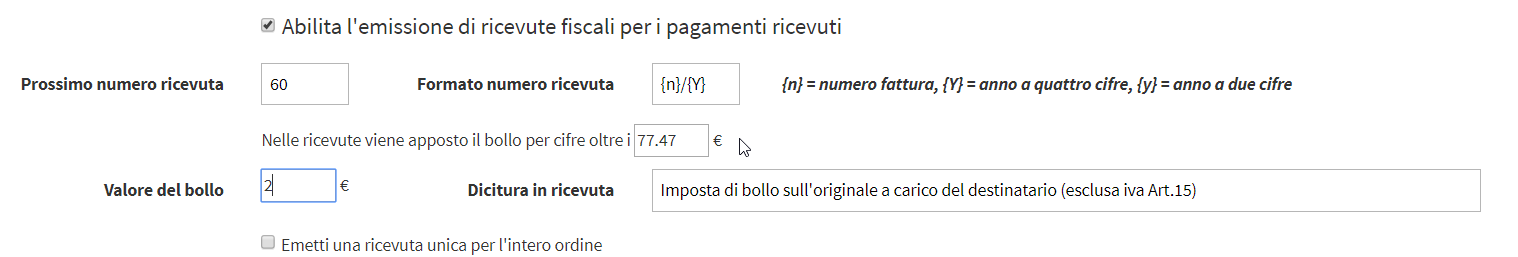

Configuration of vignette in fiscal receipts

Regarding the configuration of the tax stamp in tax receipts, scroll down to the section on tax receipts (which must have previously been enabled by valorizing the checkbox "Enable the issuance of tax receipts for payments received") and enter the amount above which the system should automatically affix the stamp in the receipt.

Below enter the value of the stamp and the wording that should automatically come out in the tax receipt, in the corresponding fields.

Click the button at the bottom of the page "Apply Changes" to save the operation.