Issuance of partial credit note

To issue a partial credit note for an invoice, navigate to Tax Management → Invoices/Credit Notes.

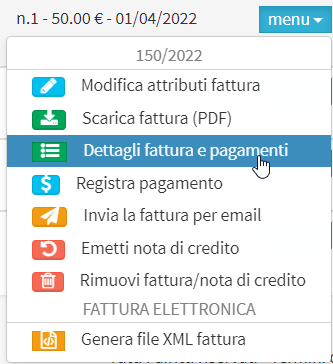

Then click the "Menu" on the line of the invoice you intend to partially write off, followed by the "Invoice and payment details".

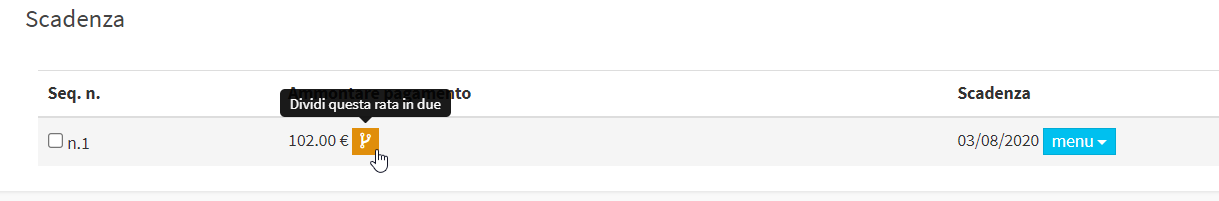

From the next screen, you will need to go down to the "Due Date" and click the orange button next to the installment amount, which will allow you to split it in two:

Note: In case the payment has already been registered, it is necessary to cancel it, split the installment and register the payment again.

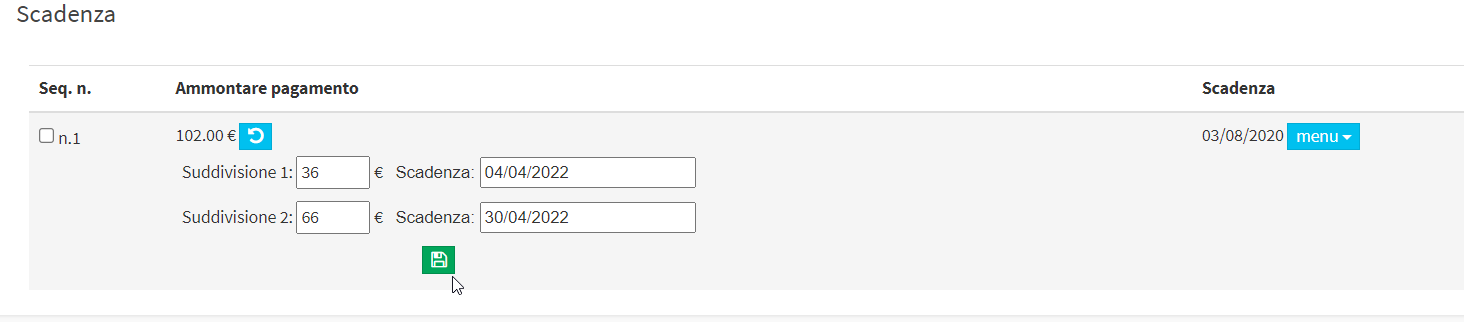

At this point, you will need to fill in the new required fields, thus entering the amount to be reversed in one installment, and the remaining amount in the other installment, also specifying the due dates for each. Click the green button below to apply the split.

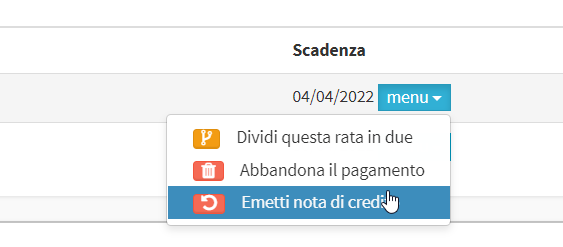

Now, by clicking the "menu" on the line of the amount to be reversed, click the "Issue credit note".

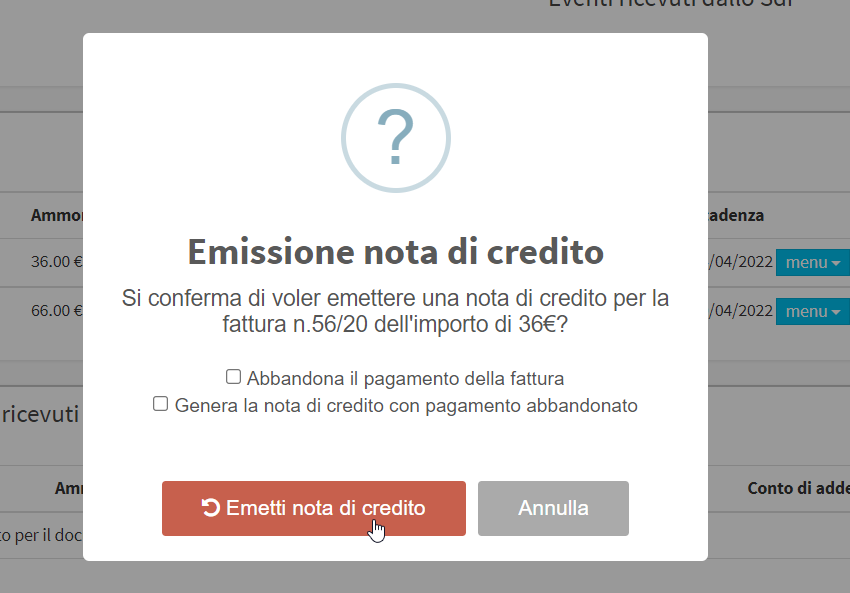

Before completing the operation, the system optionally proposes to perform the following steps:

- Abandon payment of invoice: if checked, the reversed amount will no longer appear to be receivable; only the amount that has not been cancelled will remain as residual

- Generate credit note with abandoned payment: if checked, the system will generate a credit note with no payment due, i.e., without having to record the financial output in the accounts

N.B. This pop-up represents only a way to perform multiple operations at the same time and thus make the process faster. However, if the checkmarks are not entered, the relevant actions can also be performed later.

Click the red button "Issue credit note" to terminate the transaction.