Set up a new Tax Company

To configure the school's tax information, navigate to Tax Management → Tax Settings and click the Add New Company button:

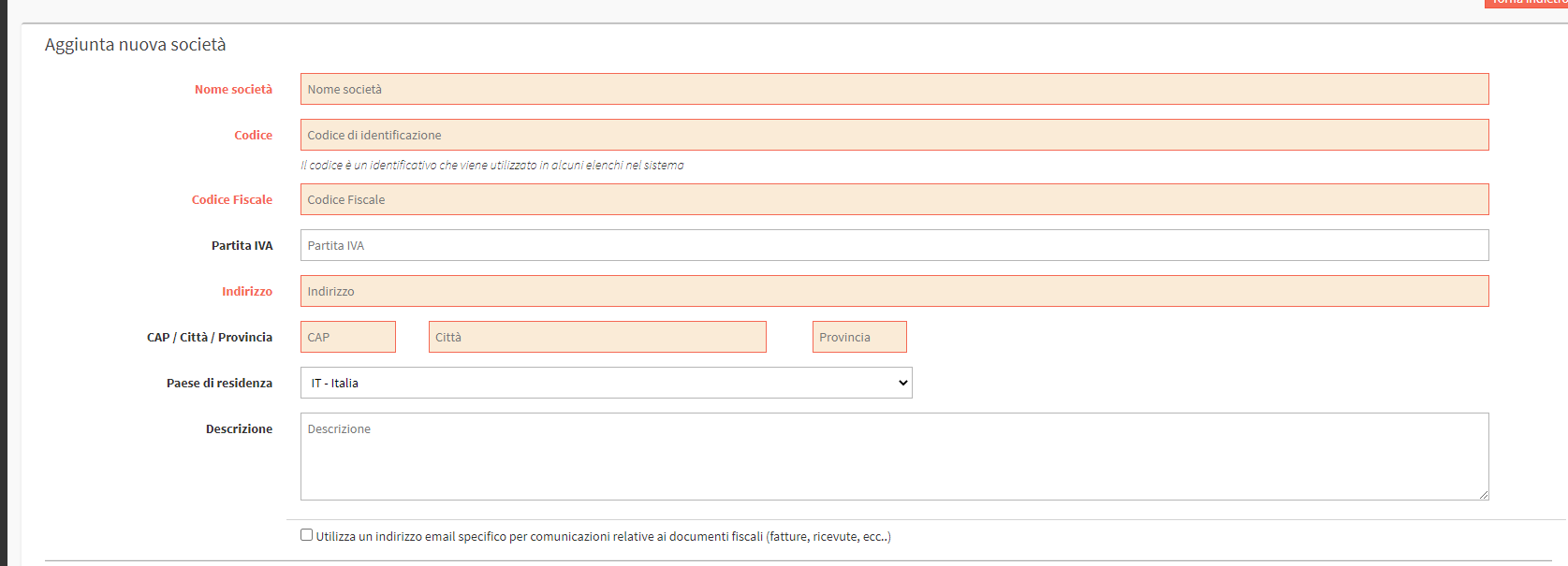

Then enter the data that is presented:

- Company name: school name

- Code: Identification code that is used in some listings in the system

- VAT number: the school's VAT number

- Tax code: the tax code of the school

- Address: the address of the school

- Zip / City / Province: zip code, city and province of the school

- Country of residence: Country of residence of the tax company.

- Description: description of the school, if any

- Use a specific email address for communications related to tax documents: If pointed allows you to enter an email address that will be used as a "Replay to" for emails sent by the system regarding the tax part.

- Next invoice: The number of the invoice from which you wish to issue the next

- Formato numero fattura: {n} e {y} rappresentano due segnaposti per il numero della fattura e per l’anno. {n} aumenterà progressivamente mano a mano che vengono emesse le fatture e {y} aumenterà progressivamente con il passare degli anni. Non dovranno quindi essere modificati a meno che non si voglia modificare il format del numero della fattura.

- Date of issue:

- Issue invoice on the date of payment received: Check if you do not want to issue the invoice on today's date but on the date of payment.

- Print negative values in credit notes: Negative numbers will be used in credit notes.

- Stamp is affixed to invoices for figures over the: Enter the digit after which the Stamp is to be affixed.

- Value of the Stamp: Specify the amount in euros of the Revenue Stamp

- Enable second set of invoices: If checked enables a second numbering for Invoices.

- Additional message on invoice: any message to be added to invoice

- Next DDT: The number of the DDT from which you want to issue the next one (put a number in each case even if it is not used)

- Enables the issuance of tax receipts for payments received: Enable the Tax Receipts system.

- 4% contribution: value the checkbox if used

- Payment method: Payment method viewable only in unpaid outgoing invoices

Fields highlighted in red must be filled in to proceed; the others can also be filled in later.

Click Add new company to conclude the operation:

More companies may be added by repeating the same operation.

Pingback: Issuing an invoice for a settled payment - The Wiki of ScuolaSemplice

Pingback: 2 - General Configuration - The Wiki of ScuolaSemplice