What should I do when an electronic invoice is rejected by SDI?

This mini-guide regarding the rejection of electronic invoices by the SDI covers only those clients who have activated electronic invoicing through CGN Fintech.

To get more information about activating the Premium Electronic Billing package with CGN Fintech contact us at: commercial@blucloud.it.

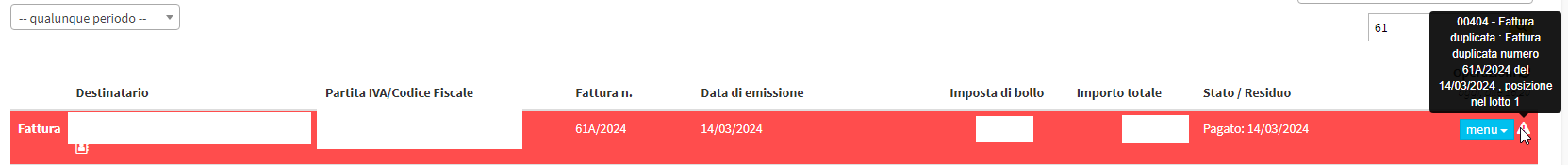

When accessing the section Tax Management→ Invoices/Credit Notes displays invoices in red, they have been rejected by SDI since they do not meet the established compliance criteria.

Once this situation occurs you will be able to view the reason for the rejection by hovering your mouse over the error symbol to the left of the Menu and a message containing a brief description of the problem will be displayed.

Once the problem is displayed, the following steps should be performed:

- Delete the XML of the invoice (NOT THE INVOICE).

- Modify the data generating the problem (if the problem is related to the invoice you can enter from Menu→ Edit Invoice, if it is related to the data of the payee you will need to modify it from his or her master data)

- Re-issue the XML

- Display the ministerial format

- Resend invoice to SDI