How to check the reason for rejecting an electronic invoice

In the event that some error has been made in the compilation of the invoice data (in general, possible errors concern the master data of the invoice holder), not complying with the canons of compliance of the XML file established by the Internal Revenue Service, it will be possible to check the type of non-compliance highlighted by the system and make the necessary changes.

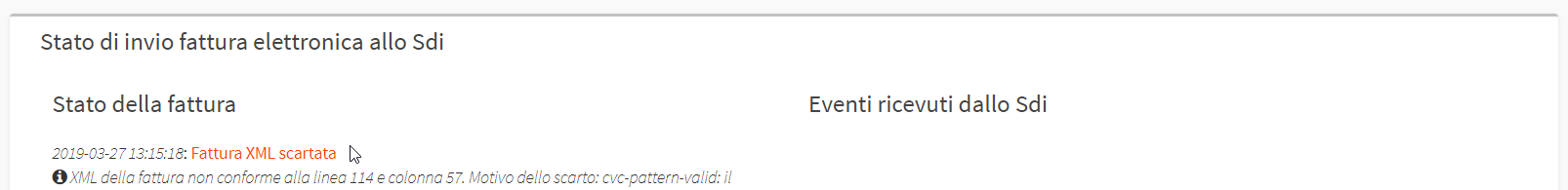

In the event that an electronic invoice is rejected by SDI due to non-compliance issues, the system will highlight it in red in the list of invoices giving the possibility to check the type of error made and to delete the XML file, and then regenerate it after making the correction.

Then click the "Menu" on the line of the invoice discarded by the interchange system and then choose the "Invoice details and payments".

After reading the type of error (which may concern, for example, incorrectly written CF or VAT number, missing residence data, etc. etc.) you will need to delete the XML invoice file by clicking the "Menu" on the invoice line highlighted in red and following the option "Delete XML invoice".

Then, after correcting the error highlighted by the system, return to the invoices section and repeat the procedure of generating XML file and sending to SDI.

LIST OF THE MOST COMMON REASONS FOR REJECTION

-

"DataPurchaseOrder: Value IdDocument Required"

-

Solution: Enter, via this guide (part two), the additional information requested by the recipient.

-

-

"The recipient's province, when present, must be two characters."

- Solution: Recipient's Province exceeds the maximum accepted number of 2 characters. Modify the Recipient's Master Data.

- "cvc-pattern-valid: the value "" is not valid as a facet with respect to the pattern "

- Solution: One or more data are missing in the invoice, check that the Recipient master is complete and that the invoice has no anomaly.

- “cvc-pattern-valid: il valore “ITXXXXXXXXXXXX” non è valido come facet rispetto al pattern “[a-zA-Z]{2}[0-9]{2}[a-zA-Z0-9]{11,30}” per il tipo ‘IBANType’.”

- Solution: The account Iban entered in Tax Management → Tax Settings → Business Account Management is incorrect. Check and edit the Iban entered.

- "Error 00423: The value of the PriceTotal field does not appear to be calculated according to the rules defined in the technical specifications."

- Solution: More than 2 decimal places were used in the unit amount or discounts on the invoice. Change the amounts using a maximum of 2 decimal places.